Getting My Forex Spread Betting To Work

Table of ContentsGetting The Forex Spread Betting To WorkGetting My Forex Spread Betting To WorkForex Spread Betting Things To Know Before You Get ThisSome Known Details About Forex Spread Betting Indicators on Forex Spread Betting You Need To KnowIndicators on Forex Spread Betting You Need To Know

Therefore, together with the common trading accounts with floating spread, a number of firms supply clients supposed ECN accounts (Electronic Communication Network). ECN Forex broker provides a platform where individuals (banks, market manufacturers as well as private financiers) trade with each other, by placing deal orders in the system. Customarily, customers have reduced spread trading on the ECN platform, however, at the same time, they pay payment to the broker during their procedure.Normally, by advertising and marketing drifting spread, brokers highlight the aspect of being absolutely "market" type and also more narrow than the taken care of one. In theory this is true, however in real trading method, particularly in an active and unpredictable market, clients with floating spread face issues to which they are not ready. Among such troubles is that the spread might raise approximately 8-10 pips for the primary currency sets.

Specialist traders, regularly making use of quit orders, can not fully predict their profession, as the broker can specifically disrupt the "stops", remembering the market circumstance. Was this short article valuable? Confirm the theory on practice As soon as opened Demonstration you will certainly be provided with academic products and also online assistance You can study CFD trading more thoroughly and also see CFD trading instances in the area How To Trade CFDs You can trade CFD free of charge, by downloading our CFD Trading Platform Web, Profession, X.

Forex Spread Betting - Questions

I have a customer who spends his working week on Foreign exchange trading. In the initial couple of years it has made a loss and we have asserted alleviation for this. HMRC are stating that this is not a trade as the customer is not purchasing the money and also just guessing. For the 2014/15 tax obligation year the client has currently made a profit which I hope will assist the instance.

You can gain from, whereby you only need to position a small deposit, or margin, to make a reasonably huge profession. forex spread betting. Expect, for instance, you intend to open up a position in Tesla shares worth 2000. The broker could provide you leverage of 5:1, so you would only have to put down 400.

The smart Trick of Forex Spread Betting That Nobody is Talking About

Spread wagers visit the website are ideal hedging devices because you can utilize them to wager that a tool will climb or drop at a reasonably inexpensive. You can take a lengthy setting in shares in XYZ that will certainly profit need to the price increase, while taking out a short setting that will certainly confirm rewarding need to the XYZ share rate autumn.

Mean, for instance, you have a common profile of shares in worldwide equities that you want to keep spent for the lengthy term. Now imagine you prepare for that international equities will certainly quickly experience disturbance and drop dramatically before correcting. You might market all the shares in your profile in the belief that you'll be able to get them back at a much lower price.

Forex Spread Betting - An Overview

A capitalist fearing a market correction might short-sell an equal quantity of spread bets in an index of international shares, allowing them to take advantage of the temporary drop - forex spread betting. At the exact same time, the financier proceeds to hold the shares within the investment profile, in the belief they will certainly prosper in the lengthy term.

They get cars at one price and then sell them at a greater cost, and also the distinction in between the 2 prices, or the "spread", produces their earnings. Spread wagering operate in precisely similarly. In financial markets, you typically see two prices priced estimate for a tool such as a money pair.

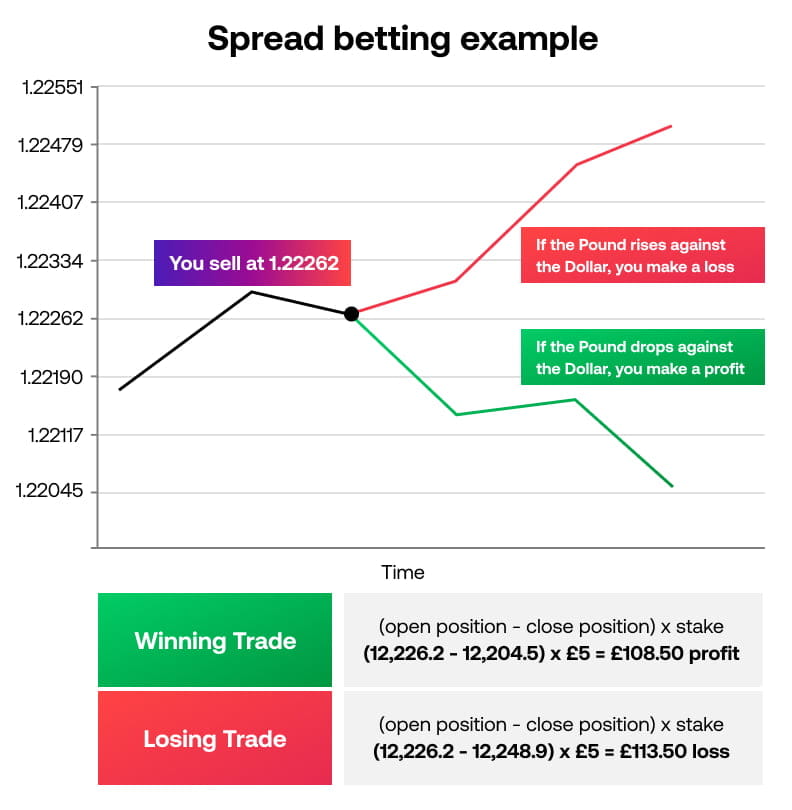

You put a spread bet based upon whether you anticipate the price of a tool to increase or drop. If you anticipate the value of a supply or bond will increase, you would open a lengthy placement, where you are the purchaser. By contrast, if you anticipate the cost of the monetary instrument to fall, you would certainly take a short position, where you are the vendor.

Forex Spread Betting Fundamentals Explained

The cost at which traders can buy an economic instrument is always more than the sell cost, and also the difference or "spread" provides the broker with a little revenue to fund their operations. A larger spread suggests there is a have a peek at these guys better difference Click This Link in between both rates, and that is normally an indicator of reduced liquidity as well as high volatility.

The bigger the spread, the better the prices sustained by the investor. Spreads are gauged in "pips", or price rate of interest factors, a measurement of the smallest cost step that a financial instrument can make. The majority of money pairs, for instance, are priced out to four decimal places as well as the pip is the last decimal factor.

Getting My Forex Spread Betting To Work

5 and has a one-point spread, it would certainly have an offer price of 5886 as well as a proposal rate of 5885, as illustrated in Figure 1. Figure 1: Spread on the FTSE 100 Index. Resource: IG Markets The wager size in spread wagering refers to the quantity that you wish to wager per unit of movement in the instrument you are trading.

If the FTSE does certainly see a gain, rising by 60 factors, your earnings would be 300 (5 x 60), whereas if the index decreased by 60 factors you would suffer a 300 loss Brokers action price movements in the underlying market in points (forex spread betting). A point of movement can represent a pound, a cent or also one-hundredth of a dime.